Word-Of-the-Week #768: Comprehension

April 25, 2019 by Susan Clarke · Comments Off on Word-Of-the-Week #768: Comprehension

Comprehension – the ability to grasp and understand what is read.

How good are you at reading and grasping the meaning of it? Do you think some people have a problem fully comprehending e-mails you’ve sent? How much digital distraction do you experience on a daily basis?

I am hoping it’s not just me, but before I send any information I make sure I have edited it at least three times. And I never send anything if I am feeling overcome by emotion. Always better to sleep on it before you send it!

I personally think we have a serious problem with comprehension. And I should add attention spans too it as well. What do you think?

“Reading comprehension is the ability to process text, understand its meaning, and to integrate with what the reader already knows.

Attention span is the amount of concentrated time a person can spend on a task without becoming distracted. The element of distractability occurs when the individual is uncontrollably drawn to some other activity or sensation. Most educators and psychologists agree that the ability to focus and sustain attention on a task is crucial for the achievement of one’s goals.” – Wikipedia

Skimming vs. Close Reading – “We live in a culture that rewards skimming: social media posts, content aggregators, blog posts, and more encourage us to skip quickly through content instead of spending the time and energy to read the texts closely and unpack their meaning.” – Rob Schombs

Larry Rosen and Alexandra Samuel of The Harvard Business Review had this to say about Conquering Digital Distraction. “Digital overload may be the defining problem of today’s workplace. All day and night, on desktops, laptops, tablets, and smartphones, we’re bombarded with so many messages and alerts that even when we want to focus, it’s nearly impossible. And when we’re tempted to procrastinate, diversions are only a click away.

This culture of constant connection takes a toll both professionally and personally. We waste time, attention, and energy on relatively unimportant information and interactions, staying busy but producing little of value. As the late Clifford Nass and his colleagues at Stanford University have shown, people who regularly juggle several streams of content do not pay attention, memorize, or manage their tasks as well as those who focus on one thing at a time.”

This week’s focus is on comprehension. Do you tend to skim and scan instead of spending the time to read it closely? How easy is it for you to focus on one thing at a time? Have you ever tried reading your communications out loud for clarity?

I LOVE feedback! Join my Facebook community on my FUN-damentals Fan Page.

Word-Of-the-Week #767: Meaningful

April 18, 2019 by Susan Clarke · Comments Off on Word-Of-the-Week #767: Meaningful

Meaningful – something that is important or has value to you.

When was the last time you did something that was truly meaningful to you? What are your fondest memories? Have you put off doing something because you didn’t want to spend the money?

This is the second half by Liz Weston on “How to know when it’s OK to spend” . To recap she wrote, “Some people are much better savers than spenders. That can become a problem.

PERMISSION TO START SPENDING

Switching from saving to spending can be hard for some people when they reach retirement age. These reluctant spenders won’t be able to change overnight.

“It’s a transition, and transitions often are rougher than anticipated and take longer than anticipated,” says neuropsychologist Moira Somers in Winnipeg, Manitoba, author of “Advice That Sticks. ”

Plus, many retirees who have trouble spending are worried their savings won’t last. Financial planners typically run computer-assisted simulations to show clients the probabilities that their portfolios will last through various markets at given levels of spending. Even then, some people have trouble turning on the tap.

“For some, it is so severe that we refer to them as financial anorexics,” says CFP John Gugle, chief investment officer of Alpha Financial Advisors in Charlotte, North Carolina. “They literally are convinced that they will run out of money despite our efforts to show them that it is virtually impossible.”

Others are able to start spending once they focus on what’s most important to them, planners say.

AN ANTIDOTE TO FEAR OF SPENDING

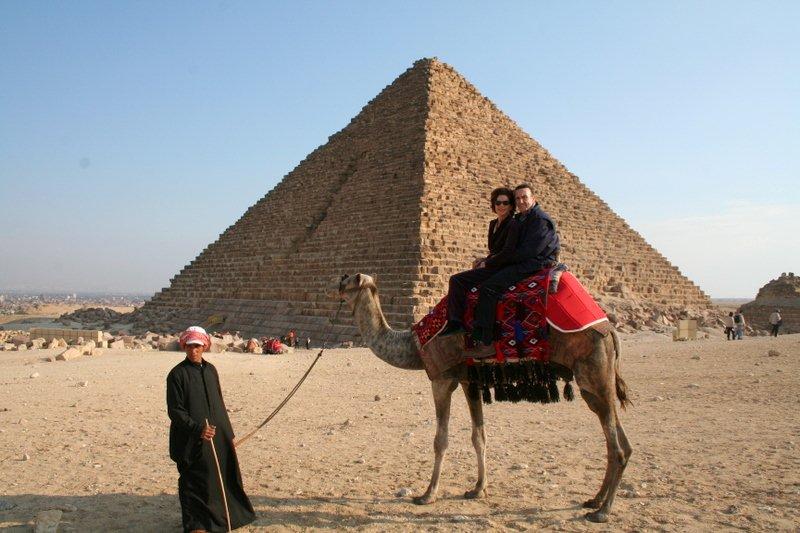

“One specific thing we suggest people do is to invest in memories, meaning do things like take your kids and grandkids on vacations that will be meaningful for you and they will remember all their lives,” says CFP John M. Scherer , founder of Trinity Financial Planning in Middleton, Wisconsin.

CFP Dana Anspach, founder and CEO of Sensible Money in Scottsdale, Arizona, has successfully encouraged clients to take trips, hire house cleaners, splurge on their dream cars and buy special-occasion jewelry after she could demonstrate the purchases wouldn’t endanger their financial plans. She also discusses the value of helping others while you’re alive to see the results of your generosity.

“In most cases, this feels far more rewarding than having family wait for you to pass and leaving them a pile of money,” Anspach says.

Then I found more on this from Travel & Leisure that says, “You’ve probably heard about the health benefits of practicing gratitude—how it can boost your mood, help you treat others better, improve physical health, and keep stress and fear at bay. Now, here’s a little trick for how to automatically infuse more gratitude into your life: Spend more money on experiences, and less on material objects.

“Think about how you feel when you come home from buying something new,” Thomas Gilovich, Ph.D., professor of psychology at Cornell University and co-author a new study on gratitude, said in a press release. “You might say, ‘this new couch is cool,’ but you’re less likely to say ‘I’m so grateful for that set of shelves.’”

“But when you come home from a vacation, you are likely to say, ‘I feel so blessed I got to go,’” he continued. “People say positive things about the stuff they bought, but they don’t usually express gratitude for it—or they don’t express it as often as they do for their experiences.”

Gilovich’s new study shows that people not only express more gratitude about events and experiences than they do about objects; it also found that this kind of gratitude results in more generous behavior toward others.

“People tend to be more inspired to comment on their feelings of gratitude when they reflect on the trips they took, the venues they visited, or the meals they ate than when they reflect on the gadgets, furniture, or clothes they bought,” the authors wrote in the journal Emotion.

I have to agree with all of this. The two biggest investments we’ve made are for our house and traveling the world. I LOVE both and I am truly grateful everyday that I get to live where I do and have gotten to see all the things I have!

This week is all about meaningful. Have you focused on what is most important to you? How would it make you feel to spend more money on experiences, and less on material objects? Plus get the benefits of gratitude and exhibit more generous behavior toward others?

I LOVE feedback! Join my Facebook community on my FUN-damentals Fan Page.

Word-Of-the-Week #766: Gratification

April 11, 2019 by Susan Clarke · Comments Off on Word-Of-the-Week #766: Gratification

Gratification – that which gives pleasure or satisfaction.

How good are you at saving money? Do you have any unused gift cards? Are you waiting for the “perfect time” to plan your dream vacation?

This from Liz Weston on “How to know when it’s OK to spend” is a timely follow up to last week’s Frugal. She writes, “Some people are much better savers than spenders. That can become a problem.

Certified financial planner DeDe Jones recalls clients, retired schoolteachers, who loved to travel but kept putting off the trip to China and Southeast Asia they’d always wanted to take.

“The husband started having health issues, and they missed the opportunity,” says Jones, managing director of Innovative Financial in Lakewood, Colorado. “The widow is doing fine financially, but is feeling regret.”

The ability to delay gratification is important for building wealth. But gratification delayed too long can leave us unhappy with the results.

Many of us experience this on a minor level when we put off using gift cards, drinking that special wine or booking a trip with our frequent flyer miles. We wait for the “perfect” time to indulge, and sometimes miss out entirely — the store goes out of business, the wine turns to vinegar, the miles expire.

THE TROUBLE WITH ‘SPECIAL’

Recent research published in the Journal of Marketing Behavior found that once we label something as “special,” we can wait too long to enjoy it.

Researchers Suzanne Shu of UCLA and Marissa A. Sharif of the University of Pennsylvania used a variety of experiments, including having participants imagine they had a free pass to a concert venue, to track people’s willingness to indulge and their self-reported satisfaction with the results. Participants could see the list of 20 musical acts that could potentially play the venue over the 15-week season, but each band was announced only the week it would be appearing. People given a “VIP access” pass waited longer to use it, hoping for a more popular act, than the people given less exclusive passes. Those who delayed often wound up settling for an act they had rated as mediocre to use the pass before it expired and expressed more regret about their choice than those who exercised the pass sooner.

Interestingly, some of the techniques that help people delay gratification can also help them avoid delaying it too long.

One technique is called “pre-commitment.” We make hard decisions in advance, such as agreeing to future automatic increases in our 401(k) contributions or paying for a dozen personal training sessions at the gym. For those who have trouble spending, pre-commitment could mean buying the airline tickets for that special trip or setting a deadline for making a purchase.

Having a financial plan can also help. Knowing you’re on track saving toward retirement and other goals can give you permission to enjoy your spending, says CFP Charlie Bolognino, president of Side-by-Side Financial Planning in Plymouth, Minnesota.

“In a sense, our spending then becomes something we’re expected to do: ‘I’m just following the plan!’” Bolognino says.

This week’s focus is on gratification. How often have you delayed gratification to you your own detriment? How would it feel to not wait for the “perfect time” to take advantage of something you want? Have you ever thought about making “pre-commitment” plans?

Stay tuned…more on this next week!

I LOVE feedback! Join my Facebook community on my FUN-damentals Fan Page.

FUN-video: Death Valley – Girls Looking For Pearls! – Trailer

April 8, 2019 by Susan Clarke · Comments Off on FUN-video: Death Valley – Girls Looking For Pearls! – Trailer

The Preview!

FUN-video: Death Valley – Girls Looking For Pearls! – Full Feature

April 8, 2019 by Susan Clarke · Comments Off on FUN-video: Death Valley – Girls Looking For Pearls! – Full Feature